Introduction to Stock Investment

Investing in stocks is a fundamental aspect of personal finance and wealth accumulation. Stocks represent ownership in a company, essentially granting the investor a share of the company’s profits and assets. When an individual purchases shares of a publicly traded company, they are investing in the company’s future growth and potential profitability. This investment offers a unique opportunity to participate in the success of businesses across various industries.

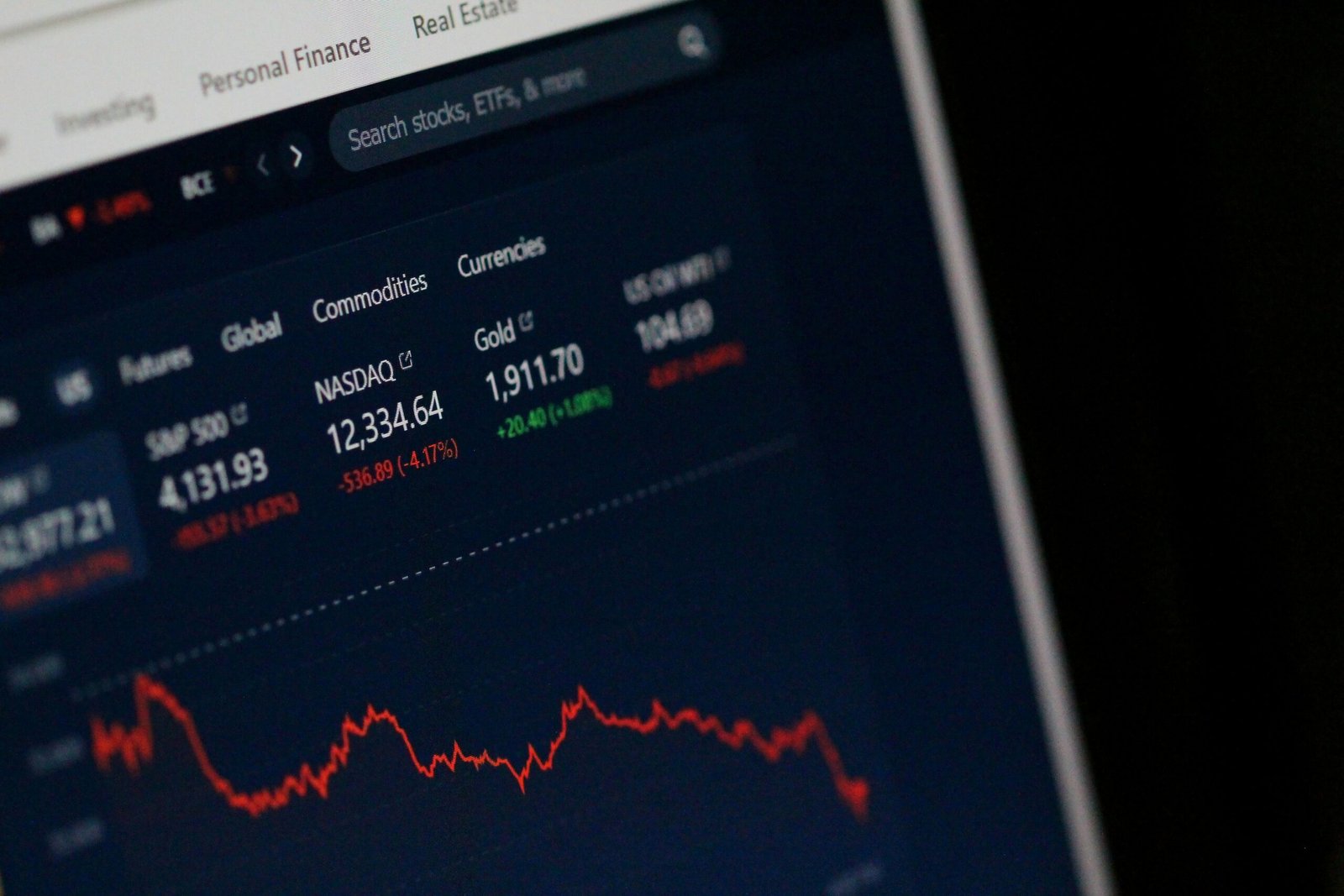

The stock market functions as a platform where buyers and sellers can trade shares. Prices of stocks fluctuate based on various factors, including market demand, economic conditions, and company performance. Understanding these elements is critical for anyone looking to build a robust investment portfolio. As part of the investment process, it is essential to recognize the importance of diversification. This strategy involves spreading investments across various stocks or asset classes to mitigate risk and enhance potential returns.

Investing in stocks has gained popularity due to its potential for significant returns compared to other investment vehicles, such as bonds or savings accounts. Historically, the stock market has provided higher average returns over the long term, making it an attractive option for those looking to grow their wealth. However, stock investments also come with inherent risks, including market volatility and the potential for losses. Therefore, understanding how to choose the right stocks for your investment portfolio is essential for success.

As you embark on the journey of stock investment, it is crucial to educate yourself on the various types of stocks, such as common and preferred shares, and the indicators that signal whether a stock is a suitable addition to your portfolio. Armed with this foundational knowledge, you will be better equipped to navigate the complexities of the stock market and make informed investment decisions.

Understanding the Different Types of Stocks

Investing in the stock market requires a clear understanding of the various types of stocks available, as this knowledge is crucial when considering how to choose the right stocks for your investment portfolio. Broadly, stocks can be categorized into several types, each with distinct characteristics, benefits, and risks.

Common stocks are perhaps the most recognized type. When investors buy common stocks, they gain ownership in the company and the right to vote on corporate matters. This ownership provides the potential for capital appreciation as well as dividends, although dividends are not guaranteed. For instance, companies like Apple and Microsoft offer common stocks that have historically provided substantial returns, making them widely sought after by investors.

On the other hand, preferred stocks represent a hybrid of equity and fixed income. They offer dividends that are typically higher than those of common stocks and are paid out before dividends to common shareholders. However, preferred stockholders generally do not have voting rights. An example of preferred stock might include shares in established companies such as Bank of America, where investors seek stable income rather than significant capital growth.

Investors should also consider the distinction between growth stocks and value stocks. Growth stocks are shares in companies expected to grow at an above-average rate compared to their industry or the overall market, like Amazon or Tesla. Conversely, value stocks are perceived to be undervalued based on their fundamentals and may appeal to investors looking for bargains, such as Procter & Gamble or Coca-Cola. Understanding these categories and their characteristics can significantly aid in how to choose the right stocks for your investment portfolio, aligning investment strategies with risk tolerance and financial goals.

Assessing Your Investment Goals and Risk Tolerance

When embarking on the journey of investing, the first step is to clearly define your investment goals. This involves identifying what you hope to achieve with your investments, which may vary from short-term profits to long-term wealth accumulation. Short-term goals could include saving for a major purchase or an upcoming expense, while long-term objectives may focus on retirement savings or funding a child’s education. Establishing these goals will guide your decisions on how to choose the right stocks for your investment portfolio.

In conjunction with your investment goals, understanding your risk tolerance is essential. Risk tolerance refers to the degree of variability in investment returns that you are willing to withstand. Factors influencing this tolerance include your age, financial situation, investment timeline, and psychological comfort with market fluctuations. For instance, younger investors might have a higher risk tolerance as they have time to recover from potential losses, while individuals nearing retirement might prefer safer investments to protect their capital.

To effectively assess your personal financial situation, consider creating a detailed budget that outlines your income, expenses, assets, and liabilities. This will help you ascertain how much you can afford to invest and identify any cash reserves you should maintain for emergencies. Aligning your investment choices with your financial capabilities and risk tolerance is crucial to constructing a robust investment portfolio.

Additionally, a well-rounded approach to stock selection should incorporate diversification to mitigate risk. By allocating your investments across various sectors and asset classes, you reduce the impact of poor performance from a single investment. Balancing your portfolio in accordance with your investment objectives and risk appetite will ultimately enhance your capacity to make sound and prosperous stock selections.

Researching Stocks Effectively

When considering how to choose the right stocks for your investment portfolio, effective research is fundamental. This process typically involves two principal analysis methods: fundamental analysis and technical analysis. Each method serves a distinct purpose and can significantly enhance decision-making when evaluating potential stock investments.

Fundamental analysis focuses on assessing a company’s financial health and performance metrics. Investors can start by scrutinizing key financial statements such as income statements, balance sheets, and cash flow statements. Important indicators to consider are earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE). These metrics not only offer insights into a company’s profitability and financial stability but also help in comparing it with industry peers. Moreover, it’s beneficial to look into the company’s market position, competitive advantage, and management team, as these factors can influence long-term growth potential.

On the other hand, technical analysis involves examining stock price movements and patterns over time. Investors utilize charts and technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to gauge market trends and forecast future price movements. By identifying patterns and signals within the price action, investors can determine optimal entry and exit points for trades. Resources such as charting software and investment apps can assist in this technical scrutiny, enabling users to apply different analytical tools effectively.

To facilitate the research process, a variety of tools and resources are available, including online brokerage platforms, financial news websites, and dedicated stock analysis software. Investors should leverage these platforms to access comprehensive data and stay updated on market trends. By combining both fundamental and technical analysis, individuals can form a well-rounded view, thereby enhancing their ability to choose the right stocks for their investment portfolio.

Evaluating Company Performance and Industry Trends

When considering how to choose the right stocks for your investment portfolio, evaluating a company’s performance is a critical step. One of the most commonly used metrics in this evaluation is the Price-to-Earnings (P/E) ratio. This ratio provides insight into how much investors are willing to pay for each dollar of earnings. A higher P/E ratio may suggest that the market expects future growth, while a lower P/E could indicate undervaluation or a lack of growth expectations. It is important to compare the P/E ratios of companies within the same industry since what is considered a high or low ratio can vary significantly between different sectors.

Another key metric to consider is earnings growth. This figure reflects a company’s ability to increase its profits over time, and sustained earnings growth can be a strong indicator of a company’s future performance. Investors should analyze both historical earnings growth and projected growth rates, as they can provide valuable insights into a company’s overall health and long-term viability.

Return on equity (ROE) is yet another important metric that deserves attention. ROE measures how effectively a company is utilizing its equity to generate profits. A consistently high ROE can indicate that a company is well-managed and profitable, providing a compelling reason to include it in your investment portfolio.

In addition to individual company metrics, it is vital to assess the broader industry trends and market conditions. Factors such as changes in consumer behavior, technological advancements, and regulatory developments can significantly influence stock performance. Furthermore, macroeconomic variables, including interest rates and inflation, can also impact the overall market environment. By understanding both a company’s performance through key financial metrics and the industry landscape, investors are better equipped to make informed decisions on how to choose the right stocks for their investment portfolio.

Diversifying Your Portfolio

Diversification is a vital component in establishing a robust investment portfolio, serving as a strategy to mitigate risk and enhance potential returns. By spreading investments across various asset classes and sectors, investors can shield themselves from the adverse effects of market volatility. When considering how to choose the right stocks for your investment portfolio, diversification should be at the forefront of your strategy.

One effective method of diversification involves investing in multiple sectors. Instead of concentrating your investments solely in technology or healthcare, consider including stocks from a variety of industries such as finance, consumer goods, and energy. This approach helps to balance performance, as different sectors may react differently to economic conditions. For instance, during a market downturn, consumer staples often perform better than cyclical sectors, providing a buffer against potential losses.

Additionally, diversifying across asset classes is crucial. Incorporating fixed income investments, such as bonds, can offer stability to your portfolio. Real estate investment trusts (REITs) and commodities, like gold, also provide alternatives that may perform independently of traditional stock market movements. This broadening of the asset base allows individuals to achieve a more stable overall portfolio performance.

Furthermore, it’s essential to consider geographical diversification. Investing in international markets can open up new opportunities and can often yield better returns. Exposure to foreign stocks not only allows investors to tap into emerging markets but also helps to counteract domestic market fluctuations.

By implementing these diversification strategies, investors can better position themselves to withstand market volatility and enhance their chances of achieving long-term financial goals. Making informed decisions on how to choose the right stocks for your investment portfolio encompasses understanding the importance of diversification and the potential benefits it may bring.

Using Investment Tools and Resources

Investing in stocks requires a thorough understanding of market dynamics and careful analysis. To assist investors in navigating the complexities of the stock market, various investment tools and resources are available that can greatly enhance the decision-making process. One of the primary tools at an investor’s disposal is an online brokerage platform. These platforms not only facilitate buying and selling stocks but often come equipped with educational resources, market data, and analytical tools that can help investors assess potential stock purchases.

In addition to online brokers, investment apps have gained popularity, particularly among younger investors. These apps offer user-friendly interfaces that allow individuals to monitor their portfolios in real-time, follow market trends, and execute trades. Many investment apps also feature insights and recommendations that can guide users on how to choose the right stocks for your investment portfolio, thus simplifying the investment journey.

Another valuable resource is financial news websites, which provide timely information and analyses that can shape investment strategies. Staying informed about economic indicators, corporate earnings reports, and geopolitical events is crucial; therefore, utilizing reputable financial news sources is recommended. These platforms may also offer articles and expert opinions that highlight emerging trends and sectors worth exploring.

Stock screeners are particularly useful tools that allow investors to filter stocks based on specific criteria such as market capitalization, dividends, and historical performance. By setting parameters in a stock screener, individuals can create a customized list of stocks that align with their investment goals, helping to simplify the process of how to choose the right stocks for your investment portfolio.

By leveraging these tools and resources effectively, investors can make more informed decisions, ultimately leading to a more robust investment strategy that supports their financial goals.

Staying Updated on Market Trends

Keeping abreast of market trends is essential for individuals learning how to choose the right stocks for your investment portfolio. The stock market is highly dynamic, influenced by numerous factors including economic indicators, political events, and sector-specific developments. Regularly monitoring these variables can enhance your investment strategy and decision-making process.

One of the most effective ways to stay informed is by setting up alerts for stock price changes, news updates, and specific economic indicators. By utilizing various financial news platforms and stock market applications, investors can receive real-time notifications that allow them to act promptly on pertinent information. These alerts can focus on individual stocks or broader market movements, thus enabling a proactive approach when adjusting your investment portfolio.

In addition to alerts, following reputable financial news outlets and analysts is critical for understanding market sentiment and narrative. Publications like Bloomberg, The Wall Street Journal, and CNBC provide in-depth analysis and updates that illuminate trends affecting various sectors and individual stocks. Engaging with investment communities, whether online forums or local investment clubs, can also foster continuous learning. These platforms provide opportunities to share insights, learn from experienced investors, and discuss various strategies on how to choose the right stocks for your investment portfolio.

Investing is not a one-time endeavor but rather a continuous process that requires diligence. By remaining updated with the latest market trends and economic developments, investors can adapt their strategies and make informed decisions. Through consistent engagement with financial news and investment discussions, one can significantly improve their ability to navigate the complexities of stock selection and ultimately achieve their financial goals.

Conclusion and Key Takeaways

In navigating the complex landscape of investing, understanding how to choose the right stocks for your investment portfolio is vital for success. Throughout this article, several key points have been highlighted, guiding you through the crucial factors to consider. First and foremost, it is essential to start with a clear grasp of your financial goals and risk tolerance. Each investor’s situation is unique; therefore, reflecting on your investment objectives will aid in determining the appropriate strategies to adopt.

Moreover, thorough research is fundamental when selecting stocks. Investors should analyze financial statements, evaluate management effectiveness, and assess industry trends. This due diligence allows one to uncover companies with solid fundamentals and a realistic growth potential. Additionally, diversification plays a central role in risk management within an investment portfolio. Spreading your investments across various sectors can mitigate potential losses and provide a more stable return over time.

Furthermore, remaining informed about market conditions and keeping abreast of economic indicators helps investors make timely decisions. Utilizing resources such as financial news, investment forums, and economic reports can be incredibly beneficial. As you apply the insights gained from this discussion, consider setting a regular review schedule for your investment portfolio. This practice will ensure that your investments are aligned with your changing aspirations and market environments.

Ultimately, the art of selecting the right stocks requires patience, ongoing education, and a keen awareness of your circumstances. Embrace these practices and take actionable steps to fortify your investment strategy. By employing these methods, you will be better equipped to refine your investment portfolio and potentially achieve financial success. Start today by putting these principles into action, harnessing your newfound knowledge for enhanced investment performance.

FAQs on Stock Investment

Investing in stocks can be a complicated affair, fraught with questions. Below are some frequently asked questions that help demystify the process of choosing the right stocks for your investment portfolio.

1. What factors should I consider when selecting stocks?

When deciding how to choose the right stocks for your investment portfolio, it is crucial to analyze various factors, including a company’s financial health, industry position, and market conditions. Earnings reports, price-to-earnings ratios, and growth potential are key indicators to evaluate when making informed decisions.

2. Is it better to invest in established companies or startups?

Both established companies and startups have their merits and risks. Established companies typically offer stability and dividends, which can be appealing in uncertain markets. Conversely, startups may present significant growth potential but also carry higher risk. Evaluating your risk tolerance is essential when selecting stocks for your portfolio.

3. How do market trends affect stock selection?

Understanding market trends is paramount for choosing the right stocks for your investment portfolio. Bull markets can signal opportunities for growth, while bear markets can indicate the need for caution. Keeping an eye on economic indicators, interest rates, and geopolitical events will help you gauge market implications on stock valuations.

4. Should I focus on dividends or capital gains?

Your focus on either dividends or capital gains should align with your investment goals. If you seek steady income, stocks that pay dividends may be preferable. On the other hand, if you are inclined toward growth, prioritizing capital gains may be more suitable. Striking a balance between the two can also be a viable approach.

5. How often should I review my stock portfolio?

Regularly reviewing your investment portfolio is essential to ensure it aligns with your financial goals and market changes. A semi-annual or annual review can help you assess performance, adjust stock selection as needed, and make informed decisions about your investments. Staying informed about both your stocks and market conditions will greatly enhance your investment strategy.